NetSuite Credit Card Processing

Las Vegas Nevada

NetSuite’s credit card processing solution, NetSuite SuitePayments, integrates payment processing services with the NetSuite platform, providing a single source for managing the entire order-to-cash cycle (O2C). The order-to-cash process is a defining part of a company’s success, and it also plays a big role in driving an organization’s relationship with the customer.

- $0 Integration Costs

- One-Click Integrations

- Turnkey Solutions

- Best-of-Breed Security

- 99.99% Uptime In Last 12 Months

- Free Training and Support

Request a Demo

NetSuite Payment Processing Benefits

Integrated credit card processing tools allow to you align the data essential to your business, i.e. orders, inventory level, shipping, manage invoices, recurring billing, and receive payments within your NetSuite ERP system, so your entire business will function more efficiently. NetSuite SuitePayments, integrates payment processing services with the NetSuite platform, providing a single source for managing the entire order-to-cash cycle.

Reduced Human Error

Improve Cash Flow

Single Solution

Data Security

Streamline Operations & Save Time

Process ACH & Credit Card Payments

Discover how an integrated credit card payment processing tool can deliver these benefits to your business type.

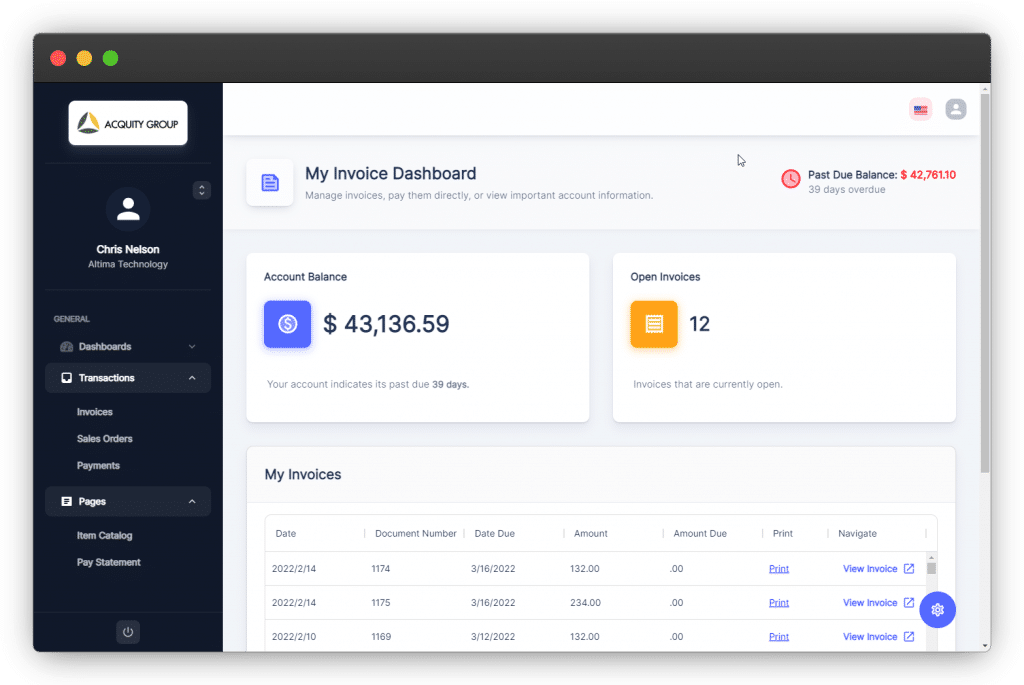

NetSuite Order to Cash process

What is NetSuite Payment Processing?

Every company, regardless of size, industry or business model, must have a way to generate revenue. For a business, this means selling goods and services to customers, either directly or via a third-party. When a customer is ready to make a purchase, a company must have a way to capture the order, deliver good or service, and receive payment for the order. The steps required to complete that process are known as the order-to-cash cycle.

NetSuite SuitePayments provides the flexibility to receive customer payments in whatever way works best for your business. Accept credit card sales online, over the phone or at the point of sale, all with PCI-compliant data security. Or, give customers the option to use digital payments such as PayPal, Apple Pay, Visa, or another digital payment method instead.

Offering Fully Integrated Suite of Payment Products

- ERP Integrated Payments

- Invoice, Deposit, & Statement Pay Links

- Customer Payment Portal

- EMV Card Reader

- ACH Payments

NetSuite Payment Processing Features

NetSuite merchant e solutions offers several payment processing options to capture funds and disburse payments for your bank account. These features connect your accounts receivable and accounts payable processes with third-party payment systems, processors, and merchant bank to collect funds and make payments.

- Accounts Receivable

- Recurring Billing

- eCommerce

- Point of Sale

Frequently Asked Questions

NetSuite’s payment processing solution, SuitePayments, integrates payment processing services with the NetSuite platform, providing a single source for managing the entire order-to-cash cycle. Accept credit card payments online, over the phone or at the point of sale, all with PCI-compliant data security. Or, give customers the option to use PayPal, Apple Pay or another digital payment method instead. NetSuite SuitePayments provides the flexibility to accept payments in whatever way works best for your business.

Companies of every size, from pre-revenue startups to fast-growing businesses, have made the move to NetSuite. Looking for a better way to run your business but wondering about the cost?

Users subscribe to NetSuite for an annual license fee. Your license is made up of three main components: core platform, optional modules and the number of users. There is also a one-time implementation fee for the initial set up. As your business grows, you can easily activate new modules and add users — that’s the beauty of cloud software.

NetSuite SuitePayments integrations are included with the NetSuite platform license, but do not include the payment services themselves. Users are responsible for contracting directly with the provider for any payment services.

Duplicate Data Entry. Eliminate errors and the resulting delays from having to log in to another system to manually charge your customer’s credit card and then update records in your accounting system.

Costly Integrations. Avoid the financial and IT resources required to build and maintain integrations with multiple payment gateways. Support the entire business with a single payment solution.

PCI Data Security Burden. Reduce the costs and complexity associated with PCI compliance by removing your company network and infrastructure from the processes used to transmit sensitive credit card data.

Using NetSuite credit card processing to efficiently handle credit card transactions for sales orders and eCommerce website orders. You can accept payment, manage card authorization, fraud management, processing costs, and funds capture for all card-not-present transactions directly from NetSuite. This end-to-end integrated solution automates the decision making process to accelerate your order to cash process and reduce the need to manually screen orders.

NetSuite credit card processing provides these benefits:

Encrypted card numbers for full PCI compliance and secure data storage

Seamless integration for card approval and funds capture for mail orders and telephone orders (MOTO), and website orders

Payer authentication and level II and level III purchase card processing for processing cost optimization

Payment holds to review orders for validity

Fraud management using CyberSource’s Decision Manager

Enhanced reporting by mapping sales order data to CyberSource reporting fields

Soft descriptors for easy card statement identification

NetSuite merchant e solutions offers several payment processing options to capture funds and disburse payments for your bank account. These features connect your accounts receivable and accounts payable processes with third-party payment systems, processors, and merchant bank to collect funds and make payments.

Accounts Receivable

SuitePayments has your accounts receivable needs covered by supporting customer-initiated payments through the NetSuite Customer Center, key entry of credit cards taken over the phone and merchant-initiated payments related to recurring billing agreements.

NetSuite Payment Link makes it easier for businesses to receive payment by including a “pay now” option on electronic and printed invoices.

Recurring Billing

For subscription, membership and recurring billing needs, SuitePayments helps mitigate declines by passing the Card-on-File and Recurring Indicator flags credit card issuers look for and by leveraging the Account Updaters services supported by payment processing gateways through their tokenization services.

eCommerce

NetSuite SuiteCommerce solutions rely on SuitePayments payment gateway integrations to complete the eCommerce checkout experience and obtain a credit card authorization as part of saving a web order. SuitePayments supports advanced fraud screening and secure checkouts via 3D Secure authentication as well as PayPal Payments and Express Checkout.

Point of Sale

For in-person transactions, use a SuitePayments partner-provided EMV chip-card-reading device to benefit from both ERP integration and card-present transaction rates — with or without SuiteCommerce InStore. No-touch, NFC-supporting options are available, including for Apple Pay.

Customers place an order through different channels.

NetSuite securely sends an authorization request together with the order information to a payment gateway. The payment gateway receives order information and performs the requested operation known as authorization.

The payment gateway formats the transaction and securely routes the authorization request to the payment processor or clearing house.

The transaction is routed to the issuing financial institutions (shopper’s bank) to request placing a hold on the shopper’s funds.

The transaction is authorized or declined by the issuing bank.

The payment gateway forwards the point of sale payments to NetSuite.

If the issuing bank authorizes the transaction, an order is submitted in NetSuite with a Pending Fulfillment or Pending Approval status.

When you bill the sales order, NetSuite sends a capture request to the payment gateway.

The payment gateway checks with the issuing bank if funds are already authorized. If not, some gateways automatically reauthorize funds.

If funds are authorized, the gateway adds the capture request to a batch of requests. This batch is sent to the issuing bank for processing at the end of every day.

The issuing bank is asked to verify the fund transfer to the merchant e account.

The issuing bank approves the transfer of money to the acquiring bank (merchant’s bank).

The acquiring bank credits the merchant’s account.

Go to Setup > Accounting > Preferences > Accounting Preferences. On the Items/Transactions subtab, in the Payment Processing section, check the Customers Can Pay Online box to allow customers to pay for the orders they place online using credit or debit cards.

Working with our SuitePayments, NetSuite provides a single solution for integrated processing and secure management of credit card transactions and digital payments. NetSuite SuitePayments ensures PCI-compliant, partner- certified communication with the payment gateway.

The NetSuite integration of PayPal provides seamless end-to-end online transactions with real-time visibility. With NetSuite, you can efficiently run it all—Web store, inventory management, order fulfillment, accounting, customer relationship management, and more. NetSuite makes it possible for you to deliver the best online shopping experience for your customers and to better manage and grow your entire business with a single system. With PayPal, you can start accepting credit cards and other forms of payments quickly. In just a few clicks, you can sign up for a PayPal account and link it to your NetSuite web store.

How do I integrate with PayPal?

Integration steps

Optional. Design an optimal checkout flow.

Required. Choose the right payment button based on your business requirements.

Required. Create a payment button using PayPal’s website.

Required. Test your payment button integration.

Optional. Set up payment notifications.

NetSuite’s payment processing solution, SuitePayments, integrates payment processing services with the NetSuite platform, providing a single source for managing the entire order-to-cash cycle. Accept credit card payments online, over the phone or at the point of sale, all with PCI-compliant data security.

NetSuite’s billing solution, SuiteBilling, automates invoices operations. Combine flat, tiered and consumption-based options with promotions, volume discounts and customer-specific rates for maximum flexibility. Support for multiple pricing models and complex rating scenarios make it easy to generate accurate invoices and balance. And, SuiteBilling lets providers manage the entire subscription lifecycle: Modify subscriptions and prorate billing, consolidate multiple charges on a single invoice and auto-generate renewal invoices to improve retention and costs.

Improve Cash Flow

Inefficient manual billing leads to invoice errors that frustrate customers and delay payments. Automating the billing process means more accurate invoicing, which accelerates payments and improves cash flow.

Enduring Customer Relationships

Consolidated billing creates trust by displaying every charge on a single invoice, while customer-specific discounts drive repeat business and automated renewals reduce subscriber churn.

Ensure Revenue Compliance

Accounting for recurring revenue can be complex and time consuming. Now you can automate this process and manage revenue accurately and in accordance with the latest revenue recognition standards.

NetSuite offers several payment processing options to a company to capture funds and disburse payments for your account. These features connect your accounts receivable and accounts payable processes with merchant third-party payment systems, processors, and financial merchants to collect funds, fees, and make payments.

Does NetSuite store credit cards?

Working with our SuitePayments, NetSuite provides a single solution for integrated processing and secure management of credit card transactions and digital payments. NetSuite SuitePayments ensures PCI-compliant, partner- certified communication with the payment gateway.

NetSuite Services Las Vegas

Our dedicated Las Vegas team of NetSuite experts has a proven, in-depth understanding of all features and functionalities of the NetSuite system. With our technical support and managed services, we help make NetSuite work for your specific business needs, NetSuite users, NetSuite projects, new modules, and give you the highest return on your investment.

We can assist you from all stages of NetSuite implementation to subsequent optimization in all areas, offering NetSuite support from basic support to advanced customer support.

Schedule A Free NetSuite Consultation?